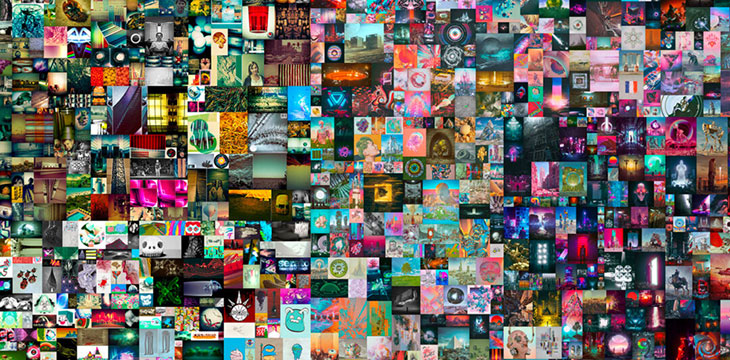

When Bitcoin was first introduced in 2008, it offered a new decentralized peer-to-peer payment system as an alternative to exchanging funds in a very centralized world, weakened by the 2007 financial crisis. A few years later, Ethereum took the use of the blockchain further, with Smart Contracts. Recently, a new kind of token has become popular, especially in the world of art and collectibles – they’re called NFTs, or Non-Fungible Tokens. NFTs have recently boomed, with sales surging to $2.5b in the first half of 2021, according to Reuters.

ART

Beyond proving the authenticity of the artwork they represent, NFTs-based artwork is one of the most popular assets for collectors, as well as speculators. Actually, some analysts consider that the rising prices and increasing accessibility of crypto trading are two factors that have helped drive interest in the NTF art market. Some NFT enthusiasts are indeed seeing collectibles as an investment opportunity to take advantage of rising interest and price fluctuations, with many trading platforms developing their own NFT marketplace to allow investors to widen their crypto trading range.

How are the blockchain and NFTs helping the art world?

This new kind of token empowers creators, by turning their digital artwork and collectibles into objects that can be easily identified and exchanged on the blockchain, as NFTs enable easier authentication, storage, and exchange of unique objects on the blockchain. That’s why they are so popular in the art business, which relies on selling unique objects whose provenance are verified by galleries or auction houses before the sale.

The blockchain is reshaping the art world by providing a new way to ensure the origin and value of an art piece, which also helps prevent fraud and counterfeit. Why? Because the blockchain technology is an open-source technology offering a new way of transferring assets, values, and now ownership.

As explained by the giant accounting and auditing company Deloitte, “the intermediary is replaced by the collective verification of the ecosystem offering a huge degree of traceability, security and speed”. The blockchain technology acts as a distributed ledger which tracks all transfers and actions happening on its network without allowing any party to modify or delete entries once they’re recorded on the blockchain. This offers transparency and traceability – two requirements in the art industry.

Bottom line

The use of blockchain in the art world has rapidly increased with the rise of NFTs or Non Fungible Tokens, as they provide a unique digital token representing an asset that cannot be copied and altered in any way.

As explained by Seth Price and Michelle Kuo in What NFTs Meanfor Contemporary Art, an NFT isn’t something that can be exchanged for something similar. While one dollar or one Bitcoin has the same value of another dollar or another Bitcoin coin, a NFT is unique and non fungible, which means that it cannot be exchanged with any like entity.

Art NFTs, which represent an artistic creation that could be fully digital, or a tokenized version of something that exists in the real world, is allowing collectors and investors to benefit from a high-er degree of authenticity and transparency, because they’re used to digitally codified the owner-ship of art pieces. Moreover, the use of blockchain with NFTs isn’t only helping to provide proof of originality and to bring more transparency to the art market, it also allows collectors to benefit from a more direct connection with the artists they like.

Marriage of NFTs and Traditional Art Proves To Be Deadly

The intersection of the NFT craze with the traditional art world presents a complex scenario where excitement about technology collides with issues of authenticity and legality. Though buying an NFT minted on the blockchain guarantees ownership, this system is revealing cracks in its foundation that could be a harbinger of problems to come.

In February, the popular trading platform OpenSea removed 1,138 NFTs after complaints from renowned artists like Damien Hirst and Anish Kapoor. They were upset that their physical works had been linked to digital tokens without their permission. This brings to light concerns about authenticity and intellectual property rights, which are far from resolved in the digital realm. Brands like Nike and Hermes have also entered the legal battleground against unauthorized NFT creators who leveraged their trademarks.

The rising issue of digital infringements is pushing trademark and intellectual property owners to seek protections akin to those they enjoy in the physical world. The initial laissez-faire attitude of trading platforms is giving way to a more responsible approach, as noted by Padraig Walsh, a partner at Tanner De Witt law firm specializing in Technology, Media, and Telecommunications (TMT) in Hong Kong. According to Walsh, this increased responsiveness to take down notices must continue if the NFT market is to maintain its momentum.

The unregulated nature of the market adds another layer of complexity. Phishing and hacking pose severe threats, as evidenced by New York-based gallery owner Todd Kramer, who lost USD 2.2 million worth of NFTs in a phishing scam. This vulnerability emphasizes the lack of regulation and oversight.

Contrary to the initial enthusiasm, the marriage of NFTs and the traditional art world appears fraught with challenges that the art community may not be ready or interested in tackling. The intersection of ownership rights, authenticity, and a virtually unregulated market creates a storm of potential pitfalls that could very well prove the assertion that the NFT craze might not endure. This melding of technology with traditional art raises questions that may continue to reverberate throughout the industry, challenging both the longevity and the very legitimacy of NFTs within the art world.